PLEASE DISTRIBUTE THIS WIDELY ON YOUR RICHMOND NEXTDOOR, NEIGHBORHOOD AND FACEBOOK POSTS.

In the shadow of a nine-person City Council Race and the Measure L Rent Control initiative, Measure M is below most people’s radar but affects everyone and is arguably the most important thing on the Richmond ballot this year.

Simply put, Measure M raises the transfer tax on real property transactions. The tax is currently 0.7%, which means that a home sold for the median sales price of $440,000 currently pays a transfer tax to the City of Richmond of $3,080, paid out of escrow when the sale closes. This tax is unique in that it is levied only when a property is sold.

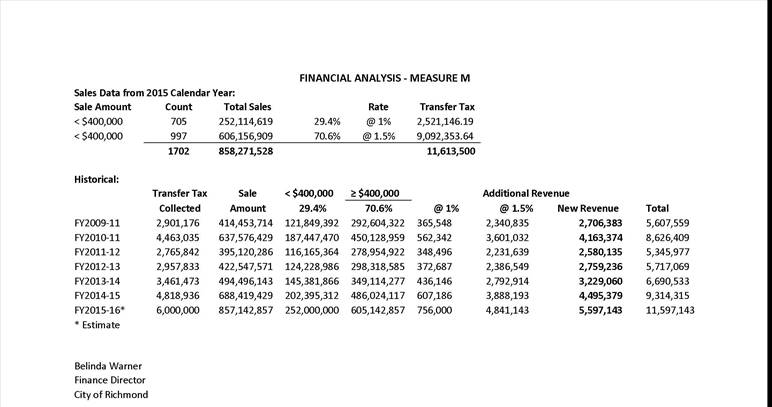

Measure M would raise the Transfer Tax rate to 1.0% on properties sold for less than $400,000 and to 1.5% on properties sold for an amount equal to or greater than $400,000. This would make Richmond’s tax similar to that in Alameda (1.2%), Albany (1.15%), Oakland (1.5%), Berkeley (1.5%) and Piedmont (1.3%).

There are about 40,000 homes in Richmond, and in 2015 there were about 1,700 transactions, mostly residential, representing slightly over 4% of the housing stock. It’s a safe bet that most of these were bank sales to investors on previously foreclosed properties or homeowners cashing out and leaving Richmond.

That means that the other 96% of homeowners are paying nothing and are not affected by real estate transfer taxes. But everyone in Richmond benefits.

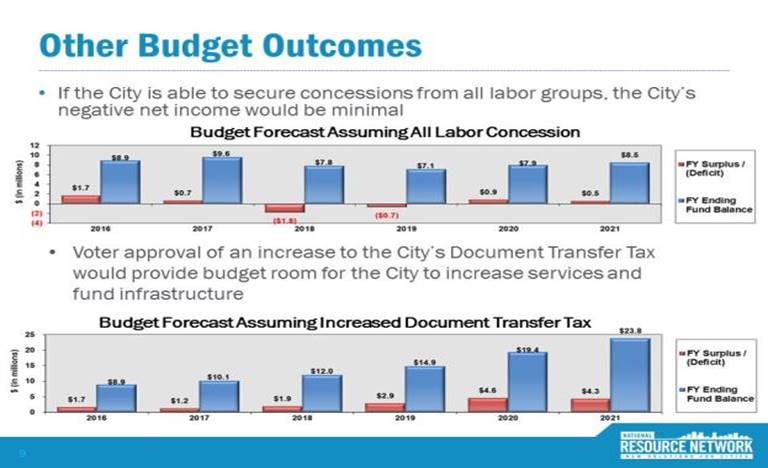

Why do we need to do this? You may recall that beginning in 2015 the Mayor’s Office secured a grant from the National Resource Network to help create an interactive 5-year budget projection model. This model was created by Russ Branson, a senior management consultant with the San Francisco firm Public Financial Management, who spent several months assisting Richmond prepare a five-year financial plan to help the city weather any financial changes. It was used to create the structurally balanced 2016-17 budget (City of Richmond Adopts Structurally Balanced FY 2016-17 Budget, July 1, 2016). Although the 2016-2017 budget is balanced, additional revenue is needed to provide sustainable budgets in the future.

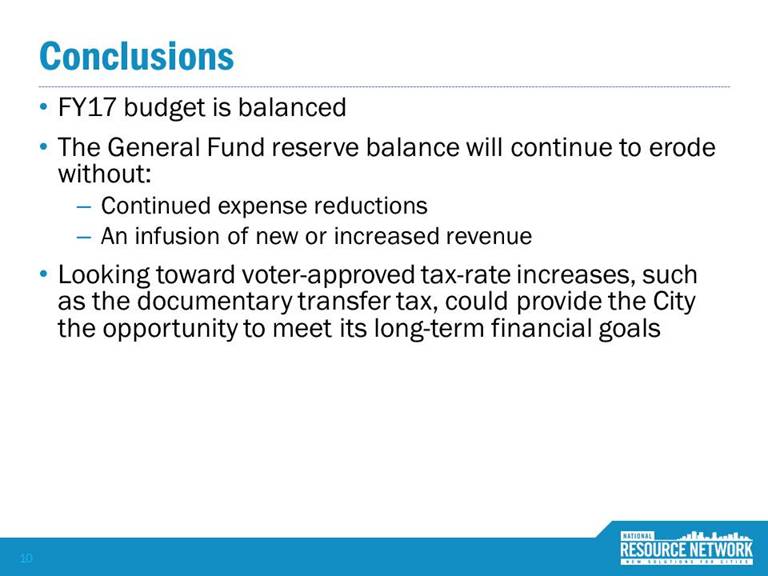

Branson made two major recommendations in his April 2016 presentation, one of which has already been partially implemented -- a labor concession resulting in a reduction of OPEB (Other Post-Employment Benefits) for public employees. The slide below from Branson’s final presentation on July 26, 2106, makes only one final recommendation: “Looking toward voter-approved tax-rate increases, such as the documentary transfer tax, could provide the City the opportunity to meet its long-term financial goals.” Measure M could raise an additional $4 million to $6 million. The City Council placed Measure M on the ballot to implement Branson’s final recommendation and put Richmond son sound financial footing for the foreseeable future.

VOTE FOR MEASURE M!

|