|

| Since sending this out a couple of weeks ago, several people have asked questions and made comments, including on Facebook and NextDoor. I would like to respond to some of them.

- No Ballot Argument in Favor of Measure M. The fact is that this just got dropped through the cracks. These arguments are submitted in August when the City Council is on recess. The RPA City Council members, who support Measure M, were busy with Measure L. Three City Council members were cranking up campaigns. Someone should have done it, probably me, but it didn’t happen. That’s no reason, however not to vote for it. The argument against Measure M was written by Jack Weir of the Contra Costa Taxpayers Association. Weir, who typically opposes all taxes, wrote in his “Political Philosophy” when running unsuccessfully for City Council in Pleasant Hill, “Direct and indirect taxes (of all kinds) now constitute the largest segment of working families' budget; this is wrong and unsustainable.” Weir never met a tax he liked.

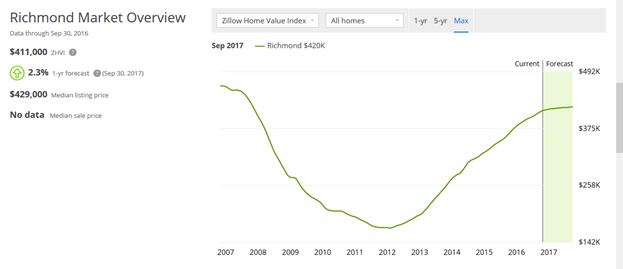

- East Bay Times Editorial. The East Bay Times editorialized against Measure M (http://www.eastbaytimes.com/2016/10/24/editorial-reject-richmond-grab-of-homeowner-equity/), saying “A transfer tax grabs property owners’ equity. It affects everyone who owns property, unless they plan to die in their homes.” The table below shows that the presumptive author of the editorial ,Dan Borenstein, is using scare tactics instead of simple math. The median price for a home in Richmond is $411,000. There are about 14,000 owned homes in Richmond, and the turnover due to sales is about 3,600 annually. Another way of looking at it is that the average ownership period is about 4 years. Someone who bought a home 4 years ago when the median price was $172,000 and sold it today, when the median price is $411,000 would make a profit of $239,000. The incremental additional transfer tax if Measure M passes would be $2,166. That’s less than 1% of the profit on the sale, not exactly grabbing “the property owner’s equity,” as Borenstein claims. It’s also about $1.50 per day during a 4-year ownership.

- Consequences of Not Passing Measure N. Several person commented that the burden was on me to convince them to vote for the tax, some arguing that the tax was for “the politicians.” The fact is that the tax is not for me and not for the City Council. It is for the residents of Richmond, who will suffer the consequences of service reductions of it does not pass. About half the residents of Richmond, who are renters, will pay nothing but will reap the benefits. A significant portion of the tax will be paid by commercial property owners who sell, not homeowners. Finally, the reduction on services resulting from not passing the tax could have a greater negative impact on property values and sales prices than the amount of the incremental tax. In other words, homeowners who do not support the tax may suffer from a decline in sales price greater than what they would have paid in Measure M incremental tax.

http://www.zillow.com/richmond-ca/home-values/

https://www.trulia.com/real_estate/Richmond-California/market-trends/

THE CASE FOR MEASURE M

In the shadow of a nine-person City Council Race and the Measure L Rent Control initiative, Measure M is below most people’s radar but affects everyone and is arguably the most important thing on the Richmond ballot this year.

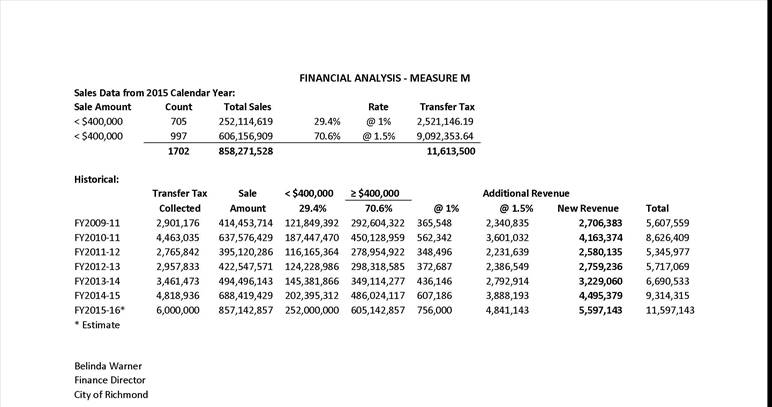

Simply put, Measure M raises the transfer tax on real property transactions. The tax is currently 0.7%, which means that a home sold for the median sales price of $440,000 currently pays a transfer tax to the City of Richmond of $3,080, paid out of escrow when the sale closes. This tax is unique in that it is levied only when a property is sold.

Measure M would raise the Transfer Tax rate to 1.0% on properties sold for less than $400,000 and to 1.5% on properties sold for an amount equal to or greater than $400,000. This would make Richmond’s tax similar to that in Alameda (1.2%), Albany (1.15%), Oakland (1.5%), Berkeley (1.5%) and Piedmont (1.3%).

There are about 40,000 homes in Richmond, and in 2015 there were about 1,700 transactions, mostly residential, representing slightly over 4% of the housing stock. It’s a safe bet that most of these were bank sales to investors on previously foreclosed properties or homeowners cashing out and leaving Richmond.

That means that the other 96% of homeowners are paying nothing and are not affected by real estate transfer taxes. But everyone in Richmond benefits.

Why do we need to do this? You may recall that beginning in 2015 the Mayor’s Office secured a grant from the National Resource Network to help create an interactive 5-year budget projection model. This model was created by Russ Branson, a senior management consultant with the San Francisco firm Public Financial Management, who spent several months assisting Richmond prepare a five-year financial plan to help the city weather any financial changes. It was used to create the structurally balanced 2016-17 budget (City of Richmond Adopts Structurally Balanced FY 2016-17 Budget, July 1, 2016). Although the 2016-2017 budget is balanced, additional revenue is needed to provide sustainable budgets in the future.

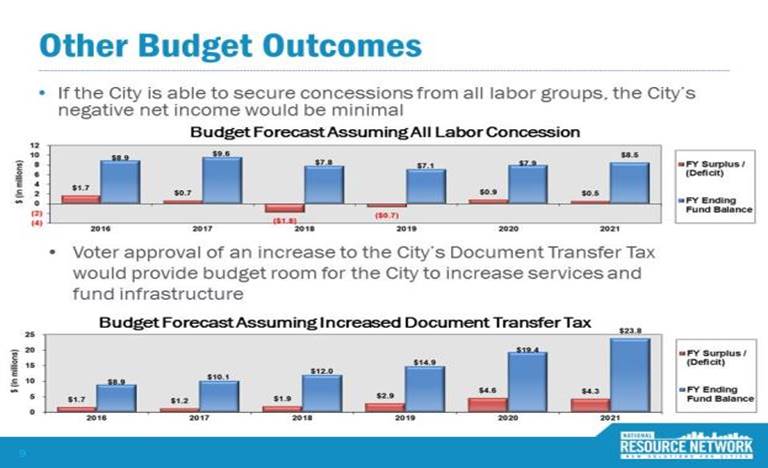

Branson made two major recommendations in his April 2016 presentation, one of which has already been partially implemented -- a labor concession resulting in a reduction of OPEB (Other Post-Employment Benefits) for public employees. The slide below from Branson’s final presentation on July 26, 2106, makes only one final recommendation: “Looking toward voter-approved tax-rate increases, such as the documentary transfer tax, could provide the City the opportunity to meet its long-term financial goals.” Measure M could raise an additional $4 million to $6 million. The City Council placed Measure M on the ballot to implement Branson’s final recommendation and put Richmond son sound financial footing for the foreseeable future.

VOTE FOR MEASURE M!

|

|